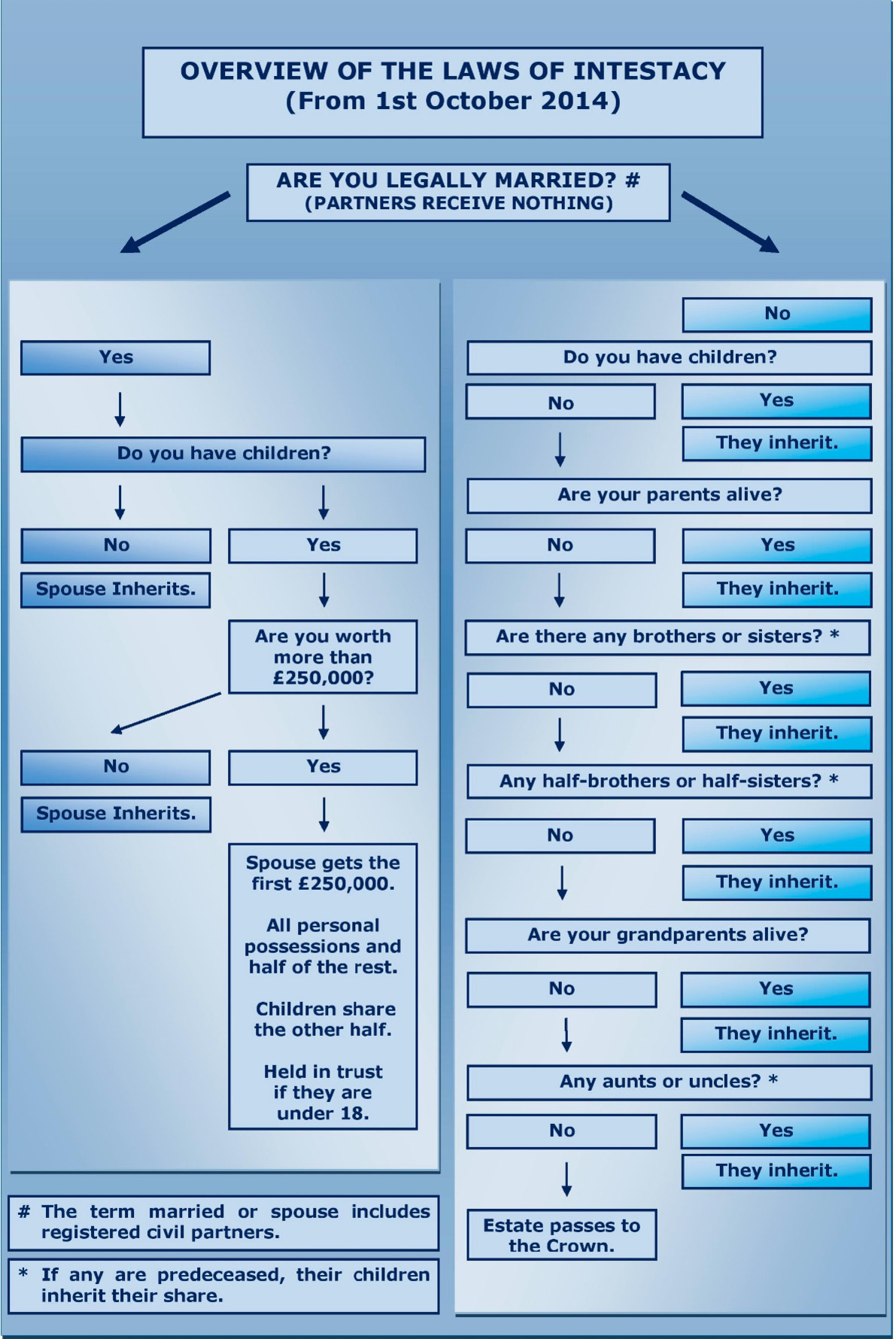

72% of the population do not have a Will. If you die without a making a Will your estate will be distributed under intestacy law (see intestacy Chart). Intestacy law makes no provision for partners or step-children who may have to claim against your estate to access money you will have wanted to give to them. Dying intestate can be more expensive to sort out your estate and your solicitor could be a major beneficiary of your estate.

Traditionally most people have opted for basic Mirror Wills which are ideal if you do not own a property. How you own your property is important particularly if you are concerned about protecting your assets from care, disinheritance, divorce or bankruptcy. The rules for care are complicated and some people think gifting their home to the children is a good idea. We disagree. By planning ahead whilst you are both still have capacity you can include a property protection trust in your Will which will protect your assets for your children.

Some people who have other assets may want to protect them as well. This is possible by including a flexible life interest trust in their Will.

Inheritance Tax can also be a major concern with the introduction of the residential nil rate band.

Discretionary trusts can be used to protect assets for disabled children, children who are vulnerable or have addictions where distribution of assets can be metered out or restricted by trustees so that your estate is most effective. Nil rate band discretionary trusts can be used to reduce inheritance tax for unmarried couples.

The establishing of Family Trusts has become more popular where families can protect assets for their children. We work with IPW approved Trust solicitors

Intestacy law

Basic Mirror Wills

The traditional Will of the past 50 years. The house is usually owned as joint beneficial tenants on death transfers to surviving joint beneficial tenant irrespective of the Will. Husband leaves everything to wife, wife leaves everything to husband, second death to children. Most suitable for people without property. These are the most common form of Will and affords no protection for the beneficiaries. Cost for two Wills is £199

How you own your property

Most people own their property as joint beneficial tenants (more commonly known as joint tenants).

If a property is owned as joint beneficial tenants on death ownership travels directly to the other joint beneficial tenant and cannot be gifted in a Will.

In order to give a share of a property away in a Will the joint beneficial tenancy must be severed to become tenants in common (which means a couple would each own half of the house). The property can be gifted in the Will as a direct gift or into trust.

Residential Care Rules

Since the 1950’s the % of the population over 60 has continued to increase from16% to 21% last year. Also improvements in medicine and living and working conditions have seen the life expectancy of males increase to 81 years old and females 86.5. It is predicted that by 2031 36% of the population will be over 60.

The number of people going into residential care has increased with 1 in 3 women and 1 in 4 men needing care at sometime in their lives. A lot has been written in the press with claims of between 48,000 and 70,000 homes being sold to meet care costs.

Following the Dilnot Report the rules on care were due to change on 1st April 2016 but due to financial pressures this has not happened.

In order to establish if a person is eligible for financial support to pay for a care home, the local authority must first carry out a needs assessment.

When a person finds themselves in a position that they need care which is not met by the NHS, the Local Authority will need to assess the person’s financial assets under the National Assistance (Assessment of Resources) Regulations 1992 (as amended).

Firstly, the Local Authority looks at the income of the person needing care. (This includes all income pensions, interest from investments, and any benefits that continue).

The Local Authority will exempt £24.90 from the income and use the rest towards the cost of care.

If there is a shortfall they will look at any capital they may have (money in banks, investments, property, shares, vehicles etc).

Note the value of the principal residence is not taken into account for the first 12 weeks of a permanent stay or if the house is occupied by:

The spouse or civil partner

A relative aged 60 or over

A disabled relative

Child under 16 and the resident is liable for their care

Also personal possessions, surrender value of life insurance or business assets of a sole trader or partnership cannot be taken into account when assessing one’s capital.

If the client has more than £23,250 then the Local Authority will not meet the difference in income and the client will be expected to pay the difference.

Where the client has less than £23,250 but has more than £14,250 the capital will be assumed to have an income of £1 for every £250 over the £14,250 and the Local Authority will pay the balance. At this stage top up fees may be required as what families often do not consider is when the local authority are funding care they will only fund to an amount after which the family may be required to pay top up fees. Instances when this might happen are if your relative:

would prefer to live in a room in a recommended care home or another care home that costs more than the council is prepared to pay

wants to live in a more expensive area to be closer to family or friends and this wasn’t identified in the needs assessment

was self-funding but is now eligible for local authority funding and wants to stay in the same home, which isn’t contracted to the council.

Gifting your home to your children to get around care costs

Not surprisingly people are looking for ways to get around care costs. In the past assets have been given away (e.g. giving the house away to the children) to try to avoid care costs. This may not be a good move for the following reasons:

If Local Authorities think that you have given away your assets to get around care costs (Depravation) they can still ask you to meet your care costs.

If your relationship with your children breaks down they could force the sale of your property.

There are tax implications. From the date of your gift it will not be a primary residence and on its sale capital gains tax will be due on any increase in the value. Income tax on the rental value is payable every year.

If your child gets divorced or is declared bankrupt your house could be sold as part of the settlement.

If your child dies before you, your house may be part of their estate and go to their beneficiaries.

Property protection trusts

Ownership of property changed from joint beneficial tenants to tenants in common (Owner share of home can now be gifted in their Will). Husband leaves his share of the house to children but grants wife a life interest in it. Remainder of estate goes to wife.

Terms of the Trust

Wife can live there for the rest of her life (or trust can be made conditional (remarriage, cohabitation)

Wife can downsize on same terms as trust

Wife has life interest in any surplus

Clause to allow spouse to access surplus if needs it.

Wife must insure and maintain property

Advantages

Children will inherit

Half home protected from divorce, bankruptcy and disinheritance

Wife has roof over her head rest of life and access to all money

Disadvantages

As tenants in common must get Grant of Probate on first death as it will be required for the sale of the house on second death.

Cost of two Wills including Deed of Severance £450

Flexible life interest trust will

Ownership of property changed from joint beneficial tenants to tenants in common (Owner share of home can now be gifted in their Will)

This Will affords the same benefits as the Property Protection Trust Will but has the extra benefits listed below

The remainder of his estate goes into a life interest trust for the children.

The terms of the trust are set out below.

The wife has a life interest in the assets in the trust meaning she will receive any interest, dividends or rent from assets in the trust.

The trustees can make loans to the wife which may be interest free, or repayable at a rate below the market rate.

The trustees can make loans to the wife which are paid back on her death

The Trustees may appoint the whole or part of the Trust Fund for the benefit of any of the beneficiaries on such terms as my Trustees think fit. An appointment may create any provisions and include discretionary trusts and dispositive or administrative powers exercisable by the Trustees.

The Trustees can transfer assets forming the whole or part of the Trust Fund to trustees of another settlement, wherever established providing all the beneficiaries agree.

The latter two points show the flexibility the trustees have to make best advantage for the beneficiaries. All properties must be owned as tenants in common.

Advantages

Children will inherit all husband’s estate

All husband’s estate protected from divorce, bankruptcy and disinheritance

Wife has roof over her head rest of life and access to all money

Flexibility for Trustees to adapt estate to most efficient trust for benefit of the beneficiaries providing they agree.

Disadvantages

As tenants in common must get Grant of Probate on first death.

The cost of two Wills is £595

NOTE IN ALL THESE WILLS ANY TRUSTS COMMENCE ON 1ST DEATH AND SO NO PROTECTION TAKES PLACE PRIOR TO FIRST DEATH

If you have any further questions please do not hesitate to contact David Nixon 01785 253329

Residential Nil Rate Band

The new IHT Residence Nil Rate Band (RNRB) was introduced in April 2017 and is in addition to an individual's own nil rate band of £325,000, However it is conditional on the main residence being passed down to direct descendants (e.g. children, grandchildren). It is also not available on estates over £2m.

The RNRB will be phased in over 4 years and the full £175,000 allowance will not be available until April 2020. The RNRB will start at £100,000 and will increase by £25,000 each tax year until 2020.

|

Tax year |

Residential Nil Rate Band |

|---|---|

|

2017/18 |

£100,000 |

|

2018/19 |

£125,000 |

|

2019/20 |

£150,000 |

|

2020/21 |

£175,000 |

By 2020/21 families could pay no IHT on up to £1M of their wealth. Each parent will have a nil-rate band of £325,000 plus a RNRB of up to £175,000. These are maximum amounts and will reduce if the value of your property is lower.

The Residence Nil Rate Band will be transferable between spouses and civil partners on death, much like the standard nil rate band. It is the unused percentage of the RNRB from the estate of the first to die which can be claimed on the second death.

This is irrespective of when the first death occurred or whether they owned residential property at their death. There will always be an additional 100% RNRB unless the first spouse's estate was greater than £2M.

The RNRB is only available where the main residence passes to children (including adopted, foster or step children) or linear descendants on death.

However, the rules have been extended to accommodate situations where the family home passes into the joint names of the deceased's child and their 5.

What if the family home passes into trust?

The residence nil rate band may be lost where, for example, the property is placed into a discretionary will trust for the benefit of the children or grandchildren.

However, some trusts for the benefit for children and grandchildren will not result in a loss of the allowance. If the trust gives a child or grandchild an absolute interest or interest in possession in the home the RNRB can still be claimed. Other trusts such as Bereaved Minor Trusts, 18 - 25 Trusts and Disabled Persons' Trusts will also retain the additional nil rate band.

The family home doesn't need to be owned at death to qualify. This is of help to those who may have downsized or sold their property to move into residential care or a relative's home.

The RNRB will still be available provided that: the property disposed of was owned by the individual and it would have qualified for the RNRB had the individual retained it; The replacement property and/or assets form part of the estate and pass to descendants.

Downsizing or the disposal of the property must take place after 8 July 2015. But there is no time limit on the period between the disposal and when death occurs.

Only one residential property will qualify. It will be down to the personal representatives to nominate which residential property should qualify if there is more than one in the estate.

A property which was never a residence of the deceased, such as buy-to-lets, cannot be nominated.

While clients may be getting some additional nil rate band to set against the family home, the basic IHT nil rate band will be frozen at £325,000 until the end of 2020/21 tax year.

Discretionary trusts for disabled or vulnerable children

If your clients have a disabled or vulnerable child or beneficiary that they wish to benefit in their wills then the best way to deal with their inheritance would be to put it into a discretionary trust.

They can put money, property, shares or any other assets into the trust.

The discretionary trust is set up by parents or other relatives in their Wills as a way of making long term financial provision for a disabled child or beneficiary.

The trust itself will be a clause in the will and will include the Trustees powers.

It is also worth bearing in mind that not to make any provision at all for a disabled son or daughter on the grounds that another member of the family will look after them or that the state will provide for them may not be a wise course. This is because under the Inheritance Act (1975) if insufficient provision is made it is possible for Social Services and the Department of Social Security to challenge the will. In turn this can result in an unpleasant, unhelpful and costly legal dispute.

The reason a trust is useful is that assets once put in trust do not belong to the "subject" of the trust (disabled son or daughter who is intended to benefit). This means that the capital held in the trust is not taken into account when assessing entitlement to state benefits like Income Support or local authority obligations to fund care.

Structure of the trust

The trust assets will be looked after by a minimum of two trustees (maximum of four) and by setting up the trust the testator is saying who they wish to look after their beneficiary’s assets. In the absence of a trust where the disabled beneficiary is unable to manage their money the Court of Protection will have to get involved and appoint a receiver. This receiver may not be the person the testator wished to look after their beneficiary’s assets.

It is termed discretionary because the trustees appointed to administer the trust have discretion subject to the terms of the trust as to how, when and by whom the capital and interest of the trust are used. Trustees are guided by a letter of wishes.

A further defining characteristic of a properly drawn up discretionary trust is that the intended beneficiary e.g. son or daughter belongs to what is termed a "class" of people and is not the sole beneficiary of the trust. Therefore we need to appoint further beneficiaries who would inherit the trust on the death of the disabled child or beneficiary. It is usually envisaged that on the death of the disabled child or beneficiary the trust will end and be divided equally between the remaining beneficiaries.

This type of trust can be used for beneficiaries have drink or drug problems so that assets go into trust and can be released to them at a time when the trustees feel they are capable of managing their affairs.

Cost of two Wills is £425, cost of a single Will is £270.

Family protection trusts

How do they work?

Set up by a client, client normally a trustee and always a beneficiary.

Client also appoints professional trustees usually solicitors.

The Trust is discretionary, so trustees decide who will benefit and by how much. This is inline with clients Will.

The trust is not limited to the lifetime of the client and can last for 120 years.

Assets up to the value of the Nil Rate Band Currently £325k) can be put into the trust. (Trust will therefore not incur trust charges).

Couples can have two Trusts (a trust each) but it is important that they are not trustees of each others Trust as this would be seen as a sham by the Local Authorities.

What can go into the trust?

YES

Property Usually paid off no mortgage

Capital Investment Bonds

Life Assurance Contracts

NO

Cash Isa’s/tessas/premium bonds/PEPS all must be turned into cash

Stocks & Shares turned into cash

Some cash allowed most but into a Capital Investment Bond

Clients advised to put the bulk of their assets into the Trust. GENERALLY SPEAKING EVERYTHING IN THE TRUST WILL BE PROTECTED (IF PUT IN EARLY ENOUGH) AND PROVIDING YOU HAVE GOOD REASON TO SET UP THE TRUST

Good reasons to take out a FPT.

FPT avoids probate Procedure (6-9 month delay accessing funds soon after death)

Recent suggestions that the cost of probate should be linked to the size of the estate could mean that this saving may offset the cost of the trust

Avoids sideways disinheritance, or children inheriting at the wrong time

Gets around dependant relatives claims.

Can make provision for disabled or vulnerable/unruly children.

Can be used for future generations inheritance tax planning.

EVERYTHING OUTSIDE WILL WHAVE TO GO THROUGH PROBATE PROCEDURE. AS THERE IS AN INTEREST IN POSSESSION ASSETS ARE NOT EXEMPT FROM IHT.

Advantages

Client keeps control

Client retains his/her Principal Private Residence exemption for CGT.

Client can access income and capital

Client can move house no problem

Assets must be in the trust 6 months prior to care (no social worker appointed)

Clients Will is implemented.

Disadvantages

Principal residence will not qualify for Residential Nil Rate Band

These trusts are expensive £2500 for a single and £3500 for a double. (includes the cost of Wills and LPAs)